Dear Performing Suppliers - September 23, 2011

Aerospace and Defense Outlook

Most forecasts for our industry at the most optimistic show a generally flat demand for A&D products. By itself this would generally dictate consolidation and conservative cost and capacity reductions. However, we also have a general consolidation trend coming from our customers who want to simplify and reduce supply chain costs. Put these two together and we get a very competitive supply environment with most suppliers reporting a downturn in revenue over 2010. Most believe this trend will continue over the next 1-2 years.

UP or DOWN?

We asked suppliers whether their business was UP over 2010 or DOWN. What did we find? Well the supply chain in general reports business is down over 2010. About 35% of suppliers report that business is UP over 2010 and the other 65% report business is flat or DOWN.

By how much? We’re hearing anything from 10-30% down over 2010. Suppliers reporting that business is DOWN are citing fewer opportunities to bid and a lot more competition on bids. The environment is more competitive and there are fewer opportunities.

But what about suppliers who invest in continuous improvement and process management? What are the rewards when the economy is down? Can a supplier who invests in improvement capture more market share even when others are not?

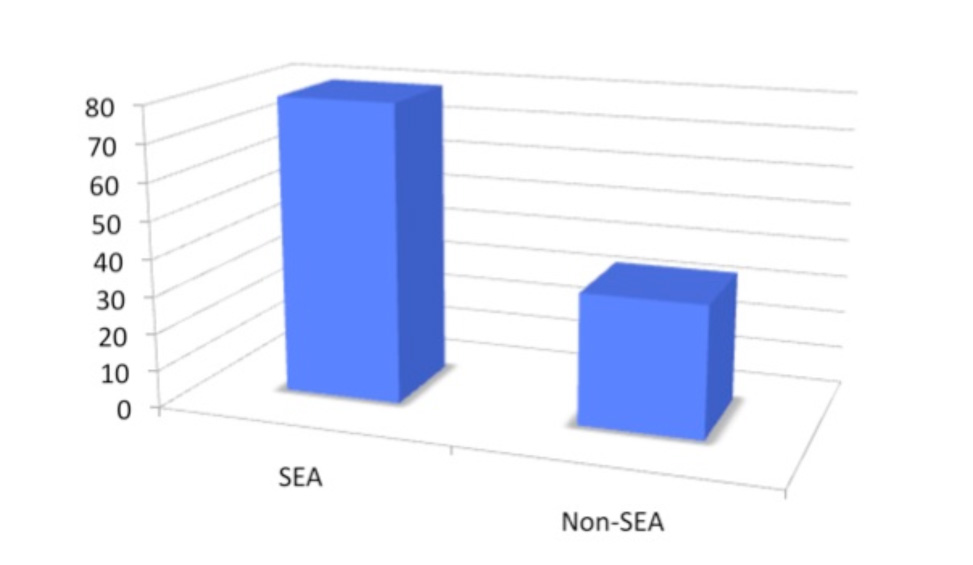

80% of SEA Suppliers who are actively engaged in the SEA process report business is UP. They are winning more business because customers who are consolidating supply chains are more likely to place long term business with suppliers who display an absolute commitment to excellence and continuous improvement.

Customer Perception

It’s very important in your decision-making about how you invest your time and effort to understand how customers perceive suppliers at this point in history. For most customers, even their best suppliers are falling apart. It’s as if the entire supply chain has suddenly lost its DNA. On-time delivery is failing; quality issues are showing up where none ever showed up before.

Of course we know that when we face uncertainty and changes, we pull back on capacity and resources. You can’t make parts if you can’t afford the materials and payroll. For “Little Q” companies, our costs go through the roof as we try to expedite, inspect, and work over-time to keep up with customers who expect 100% on-time delivery and 0 PPM quality performance. “How can it be reasonable for a customer to expect this kind of performance in this economy?” we ask. For “Big Q” companies, we simply continue to rely on a high level of process maturity while reducing our size as needed. We don’t have to cut resources we need to perform because our process maturity has built capacity with less waste and fewer resources.

But our customers don’t understand what happened. And meanwhile they are faced with the challenge of finding those suppliers who can stand the test of time and can be good partners in the longer term.

What To Do?

This has been a great opportunity for SEA Suppliers because we were prepared for a time like this. For many other suppliers it has been a very challenging and puzzling time. Here are some typical questions we find ourselves puzzling over.

Business Development – should I add more business development resources? Is it just a matter of having more sales capability? Previously most of our business just came to us and we didn’t have to do much but now it appears we need to get out there and bring in more business. Although a good business development effort may find a few more opportunities you might not have seen previously, for the most part, customer buying groups have grown impervious to the direct-in sales approach from suppliers. At a time when the economy is down, uncertainty is widespread, and supply chain consolidation is the driving force, what will a business development person do to differentiate your company? What kind of magic do you think they might conjure up?

Partnering

It is certainly true that there is strength in numbers and partnerships in our supply chain often turn up business opportunities that might not otherwise have shown up on your doorstep. A good friend in the processing business can often bring a machine shop an opportunity. A casting house can also find opportunities for machining, and of course both of these examples apply vice-versa. But less business in the supply chain means more competition. More competition means customers who go with known suppliers before trying someone they haven’t done business with before. It’s always a good time to build partnerships but these relationships take time – you must attend conferences where other suppliers go and spend time touring each others sites. And payoffs can sometimes take years to develop.

Waiting It Out

Of course this is the time-honored approach of just “hunkering down” and waiting for things to come back. Many of us are second or third generation and we know our dad’s did this many times when we were younger. Things always came back and they will now too. But the thing that is different this time is that the downturn in the market is likely to be longer, and the consolidation in the industry will create relationships that will be less likely to change as the industry does turn around. In other words, not acting now could be an advantage that you can’t recover.

Building a Company That Customers Like

What kind of supplier company do customers like? What are the characteristics of a company that customers will look at and see something different? In this market, what does “competitive” mean?

To our customers, most supplier companies don’t look mature. Our systems and processes are informal, our management is informal, we don’t have a culture or commitment to excellence. We just haven’t bothered to grow up, and now our customers are looking for and selecting grown-up suppliers.

Process Management

When a supplier company has a formal process management system, it shows up in everything we do. First, we have a process for everything important that we do and we’ve assigned a process owner to manage and continually improve that process. From Leadership, to Workforce, to Operational processes, the evidence that process maturity is important shows up as an important cultural element. Mature companies value process maturity.

Continuous Improvement and Lean

Companies who invest time and effort in continuous improvement and lean show better. Our site tours are more impressive. We have dashboards at every work area. There is ample evidence of the use of metrics on the floor. 6S workplace organization techniques are clearly evident. Even if we can’t get a customer to site visit us we can put up a simple “virtual tour” on the SEA website and share our continuous improvement and lean efforts with our customers. Mature companies value continuous improvement and lean.

Leadership

Another sign of a mature company is their formalized leadership system. No matter how small, these companies observe regular staff performance review meetings, regular planning, and regular communication on progress and results with everyone.

Workforce Development

Another sign of a mature company is their approach to continually training and developing their workforce. When processes are in place and keep working whether business is up or down, this is another sign of a mature company.

SEA Process

How does SEA help suppliers to “grow up” and attract more business? Clearly SEA has cracked the code on competing in this tough economy. 80% of SEA Suppliers are winning more business and out-performing the market.

SEA provides a roadmap outlining the most important processes requiring a process owner, a senior champion, and continuous monitoring and improvement. SEA helps your in-house effort by providing step-by-step webcasts, process owner forums, and materials all as a part of our annual membership plan designed to help small suppliers improve their maturity and gain more visibility. It’s a proven process – our results speak for themselves.

Bottom Line

You can’t sell your way into growing more market share. You need a winning strategy for differentiating yourself as a company to your suppliers. SEA’s branding strategy has been in play for over 8 years. SEA is known as the home for high-performing suppliers. Our brand stands for excellence in the A&D supply chain. It’s not easy to be a SEA Supplier but compared the work of managing a company that is failing; it’s a better option for leaders who refuse to accept defeat.

Thank you to all the SEA Suppliers who have done the hard work to make the results in this paper possible.

|

Michael Beason

Chairman, CEO

Supplier Excellence Alliance |

ARCHIVE OF PAST REPORTS

Becoming a Leader

May 24, 2013

Process Maturity for Leaders

February 26, 2013

Collaboration

November 3, 2012

Improving Your Supply Chain

October 23, 2012

What does it take to compete and win business in today’s aerospace

and defense supply chain?

April 25, 2012

Chairman's Message

January 25, 2012

Why Get Certified Anyway?

April 8, 2011

Documenting Your Roadmap Processes Will Not Improve Your Operations

September 20, 2010

The Power of Branding

May 24, 2010

Where Process Improvement Goes Wrong

March 19, 2010

Perfect Performance

March 10, 2010 |